With the tax day looming, you realize that you are running out of time. You can’t find the documents that you need or you are really in a middle of a time crunch, and you realize that you don’t have the opportunity to create your return just before the deadline.

Don’t worry!

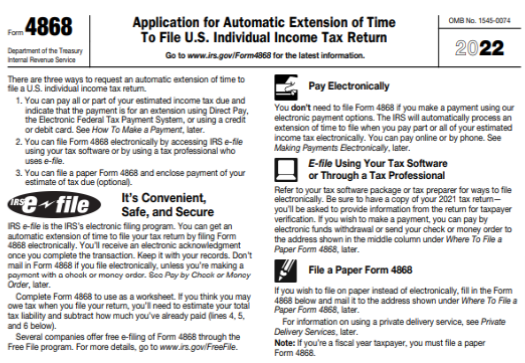

You can request the IRS for a time extension to file the federal income tax return (Form 1040). The best part is that you can easily and quickly do it online by E-filing Form 4868 with ExpressExtension.

Which Are The Forms You Can Apply For An Extension By Filing Form 4868?

For Forms 1040, 1040A,1040EZ, 1040NR, 1040NR-EZ, 1040-SS or 1040-PR you can e-file 4868 to get an extension for up to 6 months.

By Filing 4868 online you can get an instant IRS notification and you don’t need to wait for a long time.

Who Must E-file 4868?

IRS Form 4868 is applicable for:

- Federal Income Tax Returns (1040, 1040A, 1040-EZ,1040NR, 1040NR-EZ, 1040-PR or 1040-SS)

- 1099 Independent Contractors

- Sole Proprietorships (Schedule C)

- Single-Member LLCs

What Are The Special Rule To

E-File Form 4868 For Taxpayers

Who Are Out Of The Country?

Being a US resident or citizen, if you are out of the country on the due date to file your returns, you get extra 2 months to file your return and pay your tax due without requesting an extension. However, interest will be charged on the payments that are made after the regular due date, irrespective of the extension.

To qualify for the special tax treatment, you need to meet the physical or bona fide residence presence tests. Now if you can’t pass these two tests before the due date, you can easily request for a personal Tax Extension by filing form 2350. Out of the country, scenarios consist of -

- when you are living outside the US and Puerto Rico and the main place of work is outside of the Puerto Rico and the US.

- when you are in naval or military service outside the US and Puerto Rico.

Can I E-File 4868 for my spouse?

Yes, you can e-file form 4868 for your spouse. If you and your spouse jointly file the Form 4868, however, file separate returns for the current tax year, you can enter the amount paid using Form 4868 on either of the separate returns. Also, you and your spouse can simply divide the payment in agreed amounts.

Can I Pay My Balance Due?

When you are filing the form 4868, you have the option to make payment for the balance due amount in part, in full or you don’t pay anything with the extension.

However, try to pay your balance due as much as possible by May 17 to avoid a late payment penalty.

While filing the extension with 1040extensiononline.com, you can select the payment method for the balance due, which is either by EFW and Check/Money Order or Credit/Debit Card.

Penalties For Not Filing Form 4868 For Your Personal Income Tax Return?

Yes, a late filing penalty will be levied if you don't file your returns or file them after the due date (this includes even an extension). This penalty is charged from the 5% of the amount due for each month or a part of the month when your return is late. The maximum penalty charged is 25% and if the return is more than sixty days, then the minimum penalty will be $435 or the balance of the tax which is due on the return; whichever is smaller.

However, you won’t need to pay the penalty if you provide reasonable causes for not filing or filing late. For that, you must attach a statement along with your return clearly explaining the reasons.

Helpful Resources to File Form 4868

Helpful Videos to E-file Form 4868

E-file your Form 4868 and extend your 1040 filing deadline to 6 months

Recent Queries

- When is the due date to file my Form 4868?

- [E-file Error Code F4868-001-02] How do I resolve it?

- [E-File Error Code F4868-002-01] How do I resolve it?

- What if I am an “Out-of-the-Country” tax filer filing Form 4868?

- What payment options do I see while e-filing 4868?

- Once my extension is approved, how can I find my extended date?