1040 Extension - Filing Deadline

The actual deadline to file Form 1040 is April 15.

1040 Extension Form 4868 must be filed on or before the actual due date of 1040.

Form 4868 Extends your deadline up to October 15.

Information required to file a 1040 extension online

The following information is required in order to properly file 1040 Extension Online:

- Taxpayer's name

- Taxpayer's address

- Taxpayer's SSN (Social Security Number)

- Estimated amount of taxes owed in 2022 Tax Year.

- Total payment of balance due, if applicable.

- If filing jointly the same information is required from your spouse.

Note: Make sure your Social Security Number(SSN) matches with the IRS database.

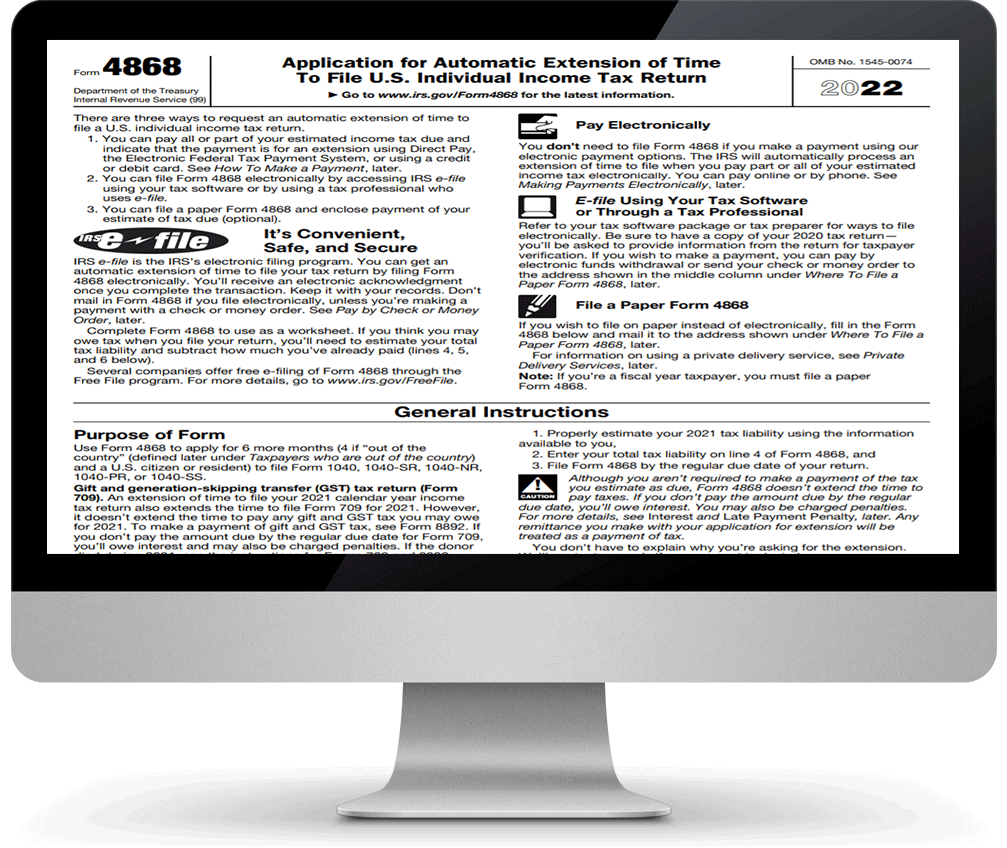

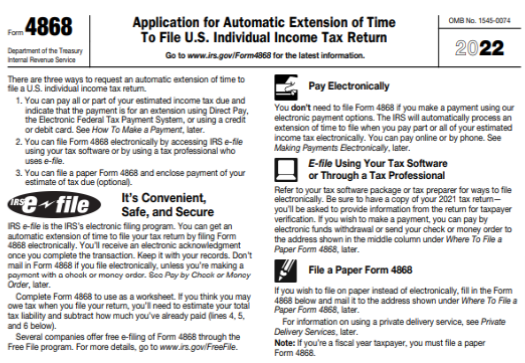

E-filing 1040 Extension Form with 1040extensiononline.com

1040extensiononline.com is an IRS authorized e-file provider which offers secure & simple filing solutions for tax extension Forms. Your Personal tax extension Form 4868 gets reviewed for any errors through our Internal Audit checks.

We provide detailed instructions throughout the filing process to simplify the filing of Form 4868. Once you transmit the return to the IRS, you will get the status instantly.

You will also have the option to opt-in for instant status through email and fax.

Visit https://www.expressextension.com/ to know more about tax extension solutions.

- Secure Bulk Filing Capabilities

- Volume Based Pricing

- Dedicated Account Manager

- Track the filing status of each client

Steps to E-file 1040 extension for the 2023 Tax Year

- Step 1: Select the extension type you would like to file.

(Either individual or joint filing) - Step 2: Enter Your Personal Details such as Name, Address, SSN

- Step 3: Enter payment details if you owe any taxes

- Step 4: Review your Form for any corrections

- Step 5: Transmit your Form 4868 to the IRS

Apply For an Extension Now

Pricing

E-file your 1040 extension Form 4868 for $12.95

Helpful Resources

Helpful Videos

E-file your Form 4868 and extend your 1040 filing deadline to 6 months

Recent Queries

- When is the due date to file my Form 4868?

- [E-file Error Code F4868-001-02] How do I resolve it?

- [E-File Error Code F4868-002-01] How do I resolve it?

- What if I am an “Out-of-the-Country” tax filer filing Form 4868?

- What payment options do I see while e-filing 4868?

- Once my extension is approved, how can I find my extended date?

Contact Us

It's free to get started with ExpressExtension. Apply for 1040 extension online for quick IRS approval. Pay only when you're ready to transmit your extension form to the IRS.

Start for FREE

Talk with a Representative

Don't wait until the deadline, especially if you have questions about e-filing 4868 extension with the ExpressExtension. Contact one of our support representatives by dialing 803.514.5155.